OK, here is what I do, how I do it, and why. If my way of doing business works for you, wonderful. If not, there are dozens of other preparers just in Castro Valley. I'm not interested in attracting as much business as possible - if so I would never sleep during tax season. I do zero advertising. What I am interested in is attracting clients who work well with my system.

I have heard about folks sitting around for hours at their tax preparer's office waiting for their return to be finalized. That is NOT going to happen here. Working at home is great - my commute is short and my office rent very low - but having a dozen folks queued up in the living room is not an option for me. And why would I want to waste your time and mine?

So to avoid that situation, clients who come here need to send me all of their tax forms and worksheets in advance. You can e-mail them, scan them, fax them, mail them, drop them off, use a carrier pigeon - whatever. I don't care how I get them as long as I get them.

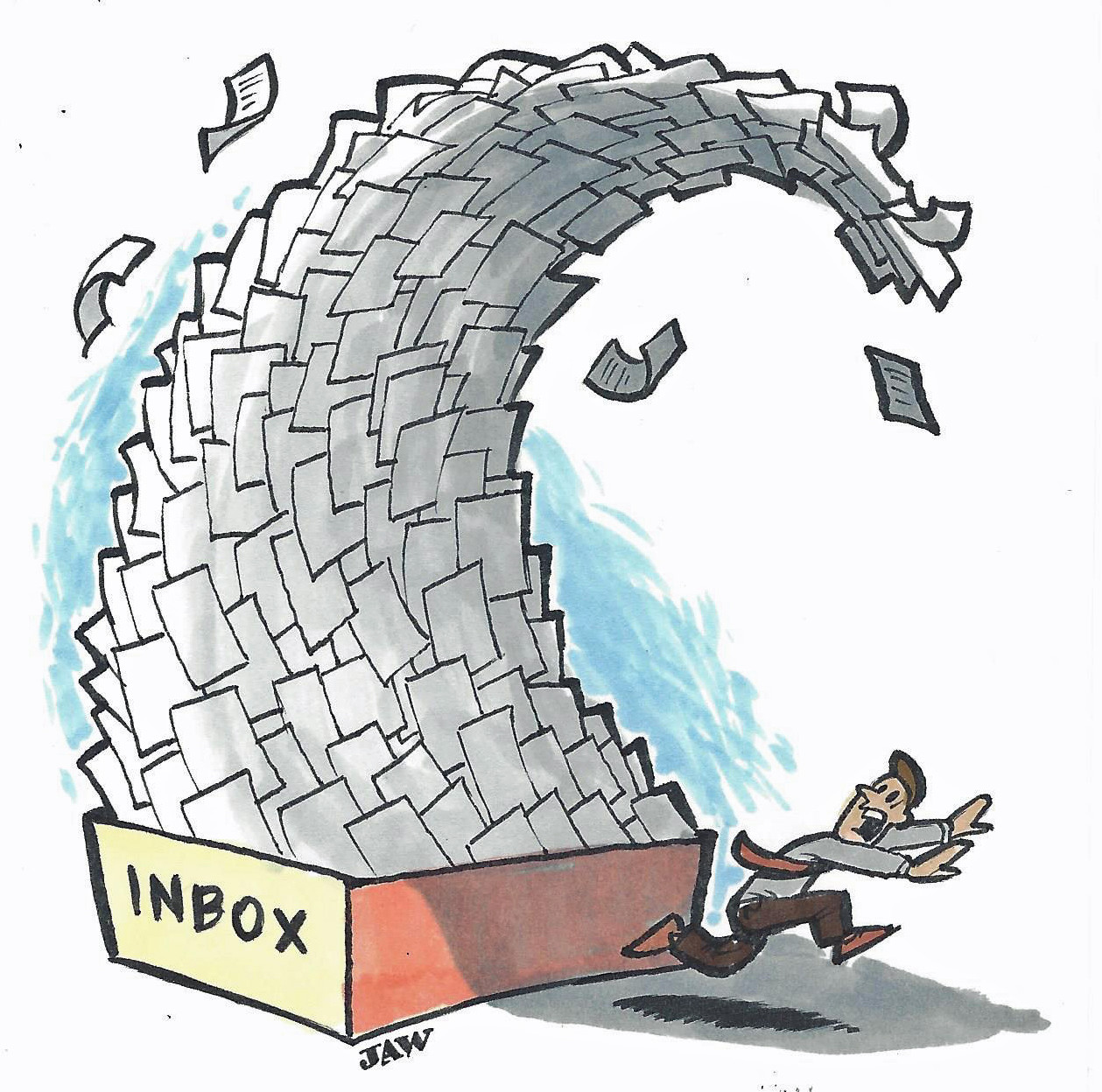

I can receive up to 30 returns per day during tax season and have learned that in this business if you get behind you may never get caught up. So my rule is that I do NOT go to bed until the inbox is empty. I am normally a late-night person and am very productive once the kids are in bed. And that means we'll be calling you Thursday to set up an appointment for the tax return you sent us Wednesday AM. The only reason incomplete tax returns sit around in my office is (a) we're missing information and you're working on getting it or (b) you're not ready to come in..

I am fine with filing extensions- actually, more than fine as it moves business from the "busy" season to later. And to keep clients from rushing in at the last minute I file extensions for free. However..

My soccer coaching and reffing responsibilities occupy much of my time starting in July. I have tons of time for taxes in May and June for those folks that need extra time to get their stuff together.

But ... I have zero tolerance for serial procrastinators. If you need more than six months to get your tax stuff together, please go somewhere else. I won't do it. EXCEPTION - if you're on of the "lucky" ones who is always waiting on a form K-1 (and these can come notoriously late) send me what you have, we'll get your return 99% done and finalize it when that K-1 finally shows up. You can't control that sort of thing.

The annual client worksheet ask the taxpayer how they want to file and how they want to receive their refund. If someone checks "e-file / direct deposit" and then leaves the bank account fields blank - we're not going to work well together. I do not expect you to know the nuances of the tax code - that is why you are paying me to prepare your tax return in the first place.

You do need to be able to completely fill in the blanks for information that is necessary to complete your return. That's why I spend hours creating those worksheets - to efficiently provide me the information we need that is NOT printed on your tax forms. If there is one word that describes my business model, it is "efficient".

I will give you my 100% honest opinion on every tax situation you will face. What we talk about in the office stays in the office. (While the cats may be present, I had them all sign non-disclosure agreements at the shelters as a condition of their adoption). After 30 years in the business, I know what the IRS and FTB can easily spot and what they tend to miss. If you feel like taking a chance, I will advise you of the corresponding risk and rewards. I have some clients who are very conservative and others who are not. I prepare each person's taxes according to their situation. Ultimately you are responsible for the content of the return that is filed. I will advise you every step of the way as much as possible.

I expect my clients to use resources I provide them BEFORE contacting me about any issues. The biggest example of this is checking refund status. Once a tax preparer files a tax return and has confirmation of filing, he/she has NO control over how the IRS or FTB process it. I provide a link on my web site where clients can check the refund status of current-year federal returns, state returns, and even prior-year amended tax returns. If someone calls me asking when they will receive their refund, I expect them to check it themselves. I'm not going to do 1,000 refund status inquiries every season. I will DEFINITELY get involved with issues that need my attention - but basic stuff that regular taxpayers can manage themselves is their venue, not mine.

Since I use a bicycle for 99% of my transportation I am usually dressed very informally. If you are my first appointment after I referee a soccer match (and I have not had time to change) I may still be in my ref uniform. If you are looking for someone in a suit and tie I am NOT your tax guy. I put all of my effort into the tax return and almost none into looking professional :-)

Surprises are nice....maybe at Christmas and birthdays. But not with tax returns. So now you know exactly what to expect from me. If this all sounds good to you, go ahead and move on to "Before We Meet" tab and see exactly how to get started. If not, time to move on and keep looking :) - Stacy Spink, SSTAR Services